Overview

Assets

$236.7 million

As of September 30, 2025

Inception Date

December 31, 2017

Holdings

35-45

Turnover

Typically 20-30%

This strategy is also available as a mutual fund. Visit RMBFunds.com for more information.

Investment Philosophy

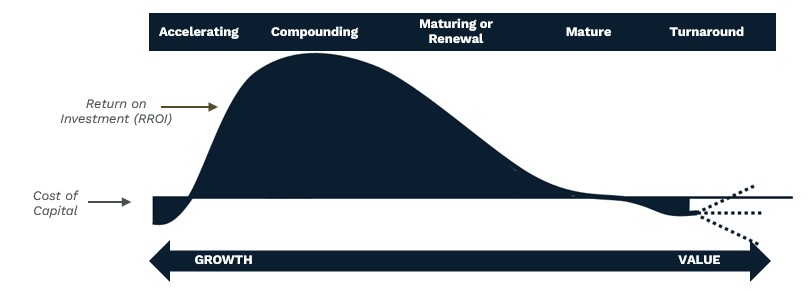

We analyze companies and construct portfolios through the lens of the Corporate Life Cycle. Companies generally progress through five stages: accelerating, compounding, maturing/renewal, maturity, and turnaround. Every company can be categorized in one of these stages. We believe that investing in companies that are allocating capital consistent with their position in the Corporate Life Cycle while controlling for portfolio risks will result in excess returns over time.

Investment Approach

The International Strategy (“the Strategy”) is a portfolio of primarily high-quality, developed-market non-U.S. stocks.

We apply a disciplined, fundamental research process to invest in what we think are well-managed companies from various stages of the Corporate Life Cycle. We utilize our unique corporate performance and valuation framework to identify companies we believe can exceed market expectations. The team also leverages Curi RMB Capital’s proprietary risk model to construct a portfolio that reflects the high conviction investments of the underlying portfolios while reducing outsized factor risks.

High Quality

We focus on management teams that we believe allocate capital appropriately for the company’s Life Cycle stage, are working to improve their competitive position, and that maintain healthy balance sheets.

Portfolio Construction

The portfolio is constructed with sufficient concentration, appropriate sector and Life Cycle diversification, and prudent position sizing.

Investment Risks

All investment incurs the potential loss of the principal investment due to risks associated with the market, sector focus, and company-specific investing. See Curi Capital’s Form ADV Part 2A for more detail and other potential risks of investing.

While “high-quality” has no single, strict industry definition, we define high-quality stocks as those that we believe offer more reliability and less risk based on a set of clearly defined fundamental criteria including hard criteria (e.g., balance sheet stability, operating efficiency, enterprise life cycle) and soft criteria (e.g., management credibility). We define well managed companies as those that intentionally grow assets when their economic return on capital is above the cost of capital, are willing to shrink assets when economic return s below the cost of capital and actively seek to improve economic return when it is approximately equal to the cost of capital.

Commentary