As your trust advisors, we seek to help you understand the tools we use to build and manage your investment portfolios. One such tool that has grown increasingly important over the past three decades is the exchange-traded fund, or ETF. Many clients have asked us how ETFs work, how they differ from other investments like mutual funds, and whether ETFs make sense for their financial goals. Let’s explore.

What Is an ETF?

At its core, an ETF is a basket of securities, such as stocks, bonds, or other assets, that trades on a stock exchange, just like an individual stock. ETF shares can be bought or sold throughout the trading day at market prices. This is one of the key differences from mutual funds, which can only be bought or sold once per day, after the markets close. ETFs were first launched in the U.S. in 1993 as a way to provide investors with low-cost exposure to a broad, diversified index — think of the S&P 500 or the Nasdaq 100. These early ETFs were designed to replicate the performance of these indexes, offering a simple, transparent way to invest in broad sections of the markets.

How ETFs Have Evolved

Since those early days, the ETF landscape has evolved dramatically. While many ETFs still track traditional market indexes, we now see a wide variety of thematic and niche-focused funds. For example, there are ETFs that specialize in clean energy, cybersecurity, or even emerging trends like artificial intelligence and cryptocurrencies. Another notable evolution is the increasing access ETFs provide to investments that were once the domain of institutional investors, such as private equity and other private markets. Historically, these types of investments required participation in complex structures like limited partnerships. Now, through innovative fund designs, investors can gain exposure to these markets in a more accessible and potentially more liquid format.

There are a few reasons ETFs have become a popular tool in portfolio construction. Keep in mind that not all benefits apply equally to all investment types or all investors.

• Liquidity

ETFs can be traded throughout the day, which adds flexibility for investors.

• Cost-Effectiveness

Many ETFs, especially those that track indexes, have lower expense ratios than mutual funds.

• Tax Efficiency

Due to the unique way ETFs are structured, they often generate fewer taxable capital gains than mutual funds.

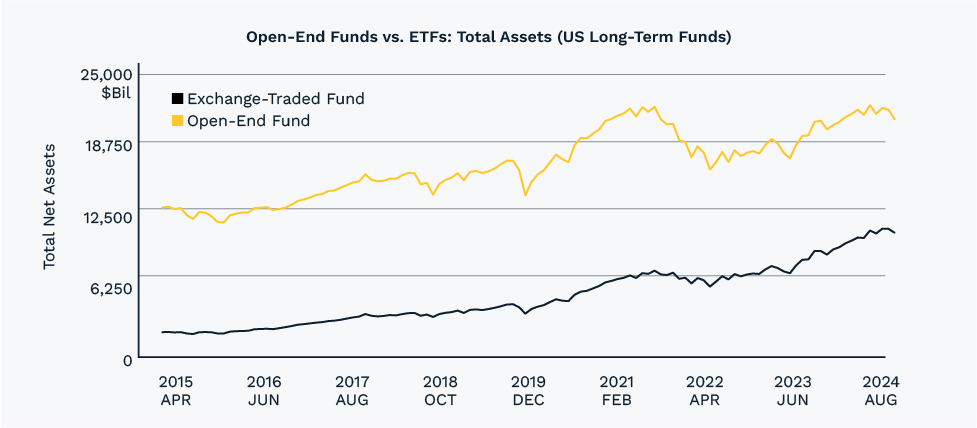

While still representing a significantly lower share of total net assets compared to open-end mutual funds, ETFs have seen steady growth in utilization and total invested assets over the past decade.

The Rise of Active ETFs

ETFs have also moved beyond their original “passive” indexing roots. In recent years, we’ve seen the rise of actively managed ETFs—funds for which investment managers make active decisions about what securities to buy and sell within the fund. While still a relatively new development compared to the decades-long history of mutual funds, the momentum toward active ETFs has gained steam. This trend now presents compelling opportunities for clients who value both professional oversight and the unique structural benefits of the ETF format. Further regulatory changes may soon allow active ETFs to be launched as a share class of existing mutual funds, which could reduce operating costs and improve efficiency industrywide. That’s good news for investors.

Important Considerations

Being able to buy and sell ETFs during the day—often referred to as “intra-day liquidity”—can be helpful in some cases. But for long-term investors, or when investing in harder-to-sell assets, this feature isn’t always necessary and can even create problems if not used carefully. For example, during a period of market stress in April 2025, some ETFs that held harder-to-sell investments didn’t trade in line with the actual value of what they owned. This happened because the system that helps keep ETF prices accurate, which is run by specialized firms called “authorized participants,” or APs, wasn’t working as smoothly as usual. These APs are like behind-the-scenes middlemen who help make sure ETF prices stay close to the value of their investments.

While this system generally works well, it can run into trouble during volatile markets or when the ETF owns less liquid assets. That’s why we believe mutual funds are often a better option for certain investment strategies, especially when the assets inside are not easy to trade quickly. In these cases, mutual funds may offer more stability and better protect long-term investors.

Our Perspective

ETFs are a powerful and flexible tool in the modern investor’s toolkit. They can offer broad diversification, lower costs, and improved tax characteristics in many cases. But like any investment vehicle, they need to be used thoughtfully and selectively. As your investment advisors, we assess each ETF individually—examining its structure, holdings, trading behavior, and liquidity—before including it in your portfolio. Our goal remains unchanged: to help you grow and preserve your wealth through smart, disciplined investing tailored to your needs.

The opinions and analyses expressed in the article are based on Curi Capital, LLC's research and professional experience. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. Investors should consult with their trusted professionals prior to taking any action.