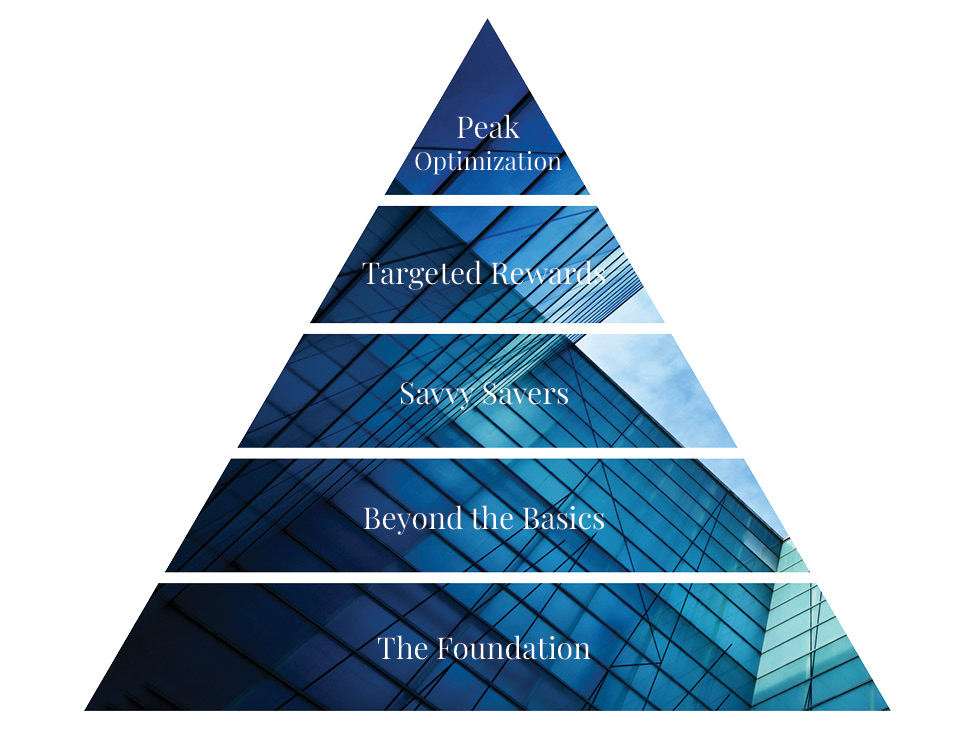

The retirement savings pyramid is a framework to help you scale from a basic foundation of state-mandated compliance to advanced strategies for highly compensated employees and owners. Where your business’s offerings land on the pyramid will depend on your company’s specific needs and determination of what makes the best fit.

The Foundation: Meeting State-Mandated Retirement Plan Requirements

In an increasing number of states, employers are now required to offer retirement savings plans—and more legislation is on the horizon. For small businesses that don’t yet provide a plan, compliance is an important reason to consider taking action.

Among the available options, a 401(k) stands out for its flexibility and long-term benefits. It allows both employer and employee contributions, offers high annual contribution limits, and includes optional features like Roth contributions, catch-up provisions, and loan access. These features not only support employee financial wellness but also help attract and retain talent in a competitive hiring market.

A Simplified Employee Pension IRA allows employers to make tax-deductible contributions to employee accounts. While it’s simple to administer and offers high contribution limits, only the employer can contribute. For businesses looking to grow with their workforces, a 401(k) often provides more strategic value.

Beyond the Basics: Smarter Plan Design

Employers can leverage several tools to enhance the effectiveness of a company-sponsored plan:

Tax Credits: The SECURE Act 2.0 introduced generous tax incentives, including a startup credit, an auto-enrollment credit, and an employer contribution credit, determined by factors such as number of employees and employee salaries.

Safe Harbor 401(k): A safe harbor provision ensures immediate vesting of employer contributions and exempts the plan from complex IRS nondiscrimination testing. Employers can choose from a basic match, enhanced match, or nonelective contribution.

Enhanced Plan Features: Consider adding Roth contributions if you don’t already have them. These allow for tax-free withdrawals in retirement and are particularly attractive to younger employees and those who expect to be earning more money in the future.

Auto-escalation is customizable and allows employees to automatically increase their savings rates annually, up to a predetermined maximum. Studies have found that employees save more money from their paychecks when enrolled in an automatic escalation program.

Savvy Savers: Mega Backdoor Roth Strategy

For employees who have maxed out traditional contribution limits but want to save more, the mega backdoor Roth strategy can offer a powerful solution.

Here’s how it works:

1. The employee makes after-tax contributions to their 401(k).

2. These contributions are then converted to a Roth IRA or Roth 401(k), potentially growing tax-free.

This approach is especially useful for high earners who exceed Roth IRA income limits. However, the feature must be built into the plan and comes with trade-offs. Since highly compensated employees are most likely to use it, there’s a risk of failing IRS nondiscrimination testing if the plan isn’t properly structured. Employers should consult plan advisors to evaluate feasibility and testing implications.

Targeted Rewards: New Comparability Profit Sharing

New comparability profit sharing allows employers to allocate different levels of contributions to different groups of employees—often based on factors like age, compensation, or years of service. It’s a strategic way to reward key employees while still meeting IRS nondiscrimination rules.

This design can enable business owners and top earners to receive a larger share of employer contributions while keeping total plan costs manageable. However, the plan must pass annual IRS general testing, and setup and administration tend to be more complex and costly.

Key benefits include maximization of retirement savings for owners and key employees and IRS-compliant plan structure with actuarial support.

Peak Optimization

At the top of the retirement planning pyramid are solutions designed to deliver significant savings opportunities to executives and business owners while also strengthening long-term retention strategies.

Cash Balance Plans: These are hybrid defined benefit plans that act like traditional pensions but with 401(k)-style flexibility. Funded entirely by employers, they provide a set benefit at retirement, based on contributions and an assumed rate of return. They’re ideal for high earners who want to contribute beyond standard 401(k) limits and benefit from large tax deductions.

Nonqualified Plans (NQPs): NQPs bypass ERISA requirements, allowing businesses to customize plans for select employees. These include deferred compensation plans, supplemental executive retirement plans, and long-term incentive plans. Because they aren’t subject to the same contribution caps, NQPs are commonly used to offer additional savings potential and enhance executive compensation packages. They require careful design and legal review but can be key tools in attracting and keeping top-tier talent.

Building a competitive, effective retirement plan doesn’t happen all at once — it’s a process that benefits from a thoughtful, tiered approach. By starting with a strong foundation and gradually incorporating more advanced strategies, you can create a plan that meets regulatory requirements, aligns with your business goals, and supports your employees’ long-term financial well-being. As your company grows, it’s important to review your plan design to ensure it remains aligned with your needs.

Our Retirement Plan Services team is here to help you navigate each stage of this journey, offering expertise and tailored guidance to help you optimize the structure of your company’s plan.

Disclaimers

The opinions and analyses expressed in the article are based on Curi Capital, LLC’s research and professional experience. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. Investors should consult with their trusted professionals prior to taking any action.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.