We recently took a look at the impact of the One Big Beautiful Bill Act (OBBBA) on tariff revenue. Download a high resolution PDF with key takeaways .

Key Takeaways

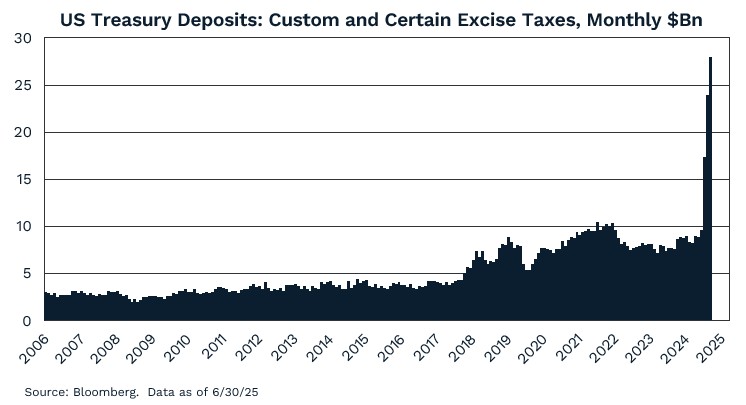

- On April 2, the U.S. government announced sweeping tariffs: a baseline 10% on nearly all imports and higher rates targeting specific countries.

- One key motivation for tariff hikes was to boost government revenue and help offset some of the deficit increase expected with the passage of the One Big Beautiful Bill Act (OBBBA).

- June saw a record $28 billion collected in custom and excise taxes. During the first half of 2025, the U.S. has collected $97 billion in tariff revenue, already matching the total annual revenue from 2024.

- Tariff revenue, which the Penn-Wharton budget model estimates could exceed $200 billion per year, may offset half nearly half of the estimated cost of extending the Tax Cuts and Jobs Act (TJCA) as part of the OBBBA.

- The TJCA forms a central part of the OBBBA and nearly all major provisions were extended while also cutting taxes on tips and social security payments. Failing to extend the TJCA would have resulted in higher taxes and left U.S. households with less disposable income.

- Despite the tax benefits, OBBBA is set to significantly increase the federal deficit over the next decade.

- We believe investors should be prepared for a wide range of outcomes and consider new ways to diversify asset allocations and investment portfolios

Disclaimers

The opinions and analyses expressed in the article are based on Curi Capital, LLC’s research and professional experience. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. Investors should consult with their trusted professionals prior to taking any action.