Why Isn’t the Market Going Down?: Q2 2023 Market Commentary

This question is at the top of many investors’ minds right now. Don’t get me wrong, we don’t want the market to go down; however, the performance for the first quarter of 2023 has been surprising to many. The S&P 500 Index was up 7.5%, the MSCI EAFE Index (developed international stock index) was up 8.7%, and the Bloomberg U.S. Aggregate Bond Index was up 3.0% for the first three months of the year. These results imply a strong start to the year.

Why does the first quarter market rally not feel great?

First, there’s the bank situation. We appeared close to a systemic financial crisis, but the issue appears resolved for now. The FDIC takeover of Silicon Valley Bank (SVB) and Signature Bank followed by Credit Suisse’s purchase by UBS appears to have stopped any type of contagion beyond those entities. The more time that passes without additional bank seizures, the better, but for now, some are waiting for the other shoe to drop.

Second, and more importantly, we seem destined for one of two negative outcomes: either the Fed keeps raising rates because inflation remains too high; or the long and much anticipated recession finally arrives. Neither outcome is desirable.

How do we make sense of it?

Let’s make a few high-probability predictions and see where they lead us.

- Maybe there’s another bank or two that ends up in trouble like SVB. If this occurs, it’s not a stretch to also assume the FDIC will step in just like before and stem further contagion so no depositors lose money. Systemic financial risk does not seem likely at this point.

- Banks are likely to further raise lending standards as they look to maintain greater liquidity to avoid a similar fate to Silicon Valley Bank. The result will be less liquidity in the market and less money available to finance economic activity.

- Inflation measures should continue to come down. We don’t know the new long-term average inflation rate yet, but we believe the worst is behind us.

- A Congressional debt ceiling showdown is approaching. Our assumption is the debt ceiling will be raised. It has always been raised in the past and defaulting on U.S. debt would be viewed as extremely reckless. However, volatility will likely ensue before the matter is resolved.

Given expectations of less lending, the lagged impact of previous rate hikes, and a U.S. Federal Reserve focused on taming inflation, recession does seem likely.

Why was the market up in Q1 and will the rally continue?

Indicators pointing to a recession were in play during the first quarter to some extent, despite that the S&P 500 Index was up 7.5% in Q1. Here are some potential reasons for the beginning of year market rally:

- The market was down 18% in 2022 and the first quarter of 2023 was just the continuation of a bear market rally that began in October of the prior year. Markets don’t move in a straight line in the short term.

- The economy was reaccelerating in the beginning of the year.

- Price-to-Earnings (PE) multiples expanded, given the drop in inflation and interest rates. Meanwhile, actual earnings for the S&P 500 were not down. Earnings estimates continue to decline, but actual company earnings have yet to deteriorate.

- Expectations for additional Fed Interest rate hikes dropped dramatically especially in the wake of SVB. In other words, a Fed pivot from tightening to loosening is expected soon.

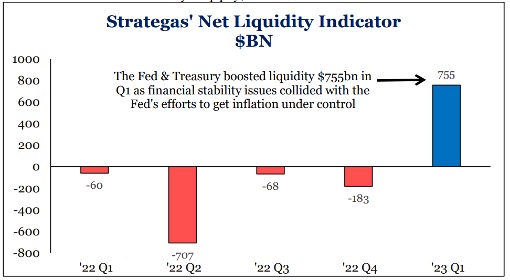

- The Federal Government injected massive amounts of liquidity into the system in the wake of SVB.

Source: Clifton, Dan. “$755 Billion Liquidity Increase in Q1.” Strategas. April 3, 2023.

Let’s say it’s safe to conclude that Q1 market strength was the result of some combination of the above reasons. Do those still hold, and could they lead to an extension of the rally? Let’s explore this further.

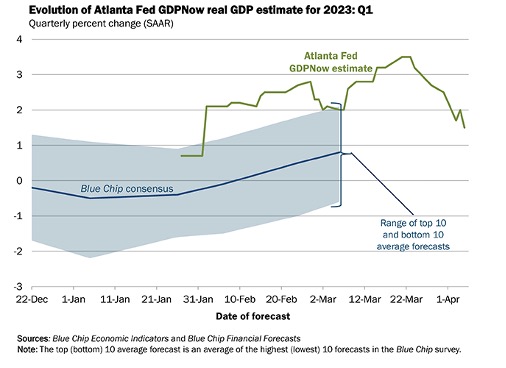

- Economic Growth

Unfortunately, the economy appears to be decelerating. The Atlanta Fed GDPNow estimate shows economic growth slowing.

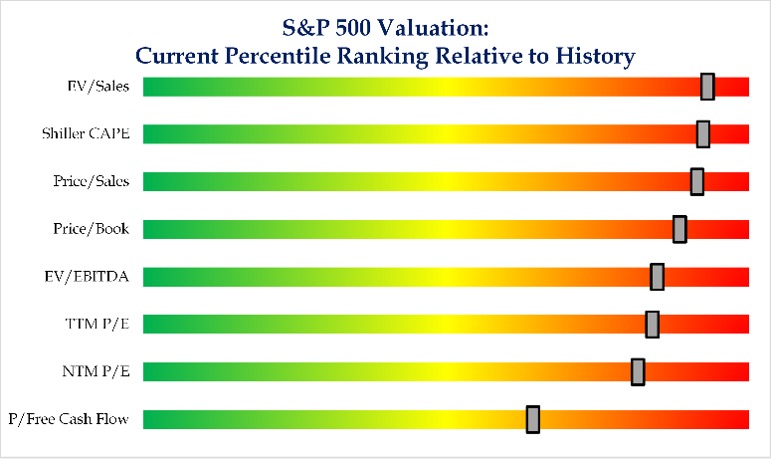

- PE Multiples

Multiples can always go higher but they’re rich on several metrics as the S&P 500 Valuation table indicates.

Source: Grabinski, Ryan. “10 Stocks Account For 90% Of The S&P Rally YTD.” Strategas. April 5, 2023.

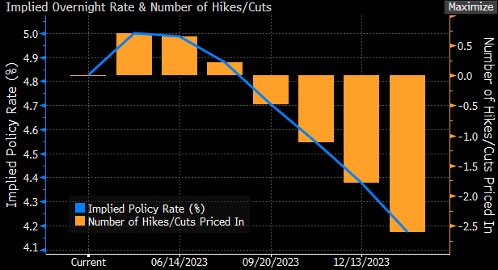

- Interest Rate Expectations

It’s tough to see the Fed easing more than the market is predicting, with rate cuts expected as early as July. Interest rate cuts would likely only occur if the economy meaningfully deteriorated, or if the recent banking crisis becomes systemic. The more likely risk is that the Fed stays tighter for longer than the market currently expects.

Source: Bloomberg Financial, LP. Data as of April 10, 2023.

- Liquidity

The federal government didn’t plan on injecting liquidity into the system. They did so because of the bank failures and their longer term stated intent is to drain liquidity through Quantitative Tightening and further interest rate hikes.

What does this all mean?

Admittedly, none of this paints a rosy picture.

On the positive side, at times like this it’s important to remember the economy and the market are not the same thing. Yes, they tend to move together over the long-term. However, they can diverge for extended periods of time. If history is any guide, the market will likely turn higher before the economy improves.

Additionally, we believe the long-term trajectory for both the market and the economy remain higher. 2022 was no fun for investors, but 2023 started off on a positive note. The short-term outlook seems problematic but we’re long-term investors and we believe the long-term outlook remains bright.

Finally, and most importantly, investors must remember to take advantage of the opportunities the market presents and there are opportunities right now. If you have upcoming spending needs, now may be a good time to raise some cash. Are you taking advantage of short-term yields? While many banks are paying paltry interest rates, money markets, short-term treasuries, and other cash instruments are paying over 4%.

Are you in the right long-term allocation? If you found you were in a portfolio that was too aggressive for your risk tolerance in 2022 but didn’t make any tweaks, the market bounce is an opportunity to reposition to a more appropriate long-term asset allocation.

There are also attractive investment opportunities right now, including alternative strategies like private credit, which have the opportunity to do well with banks expected to lend less. This may be a long-term opportunity to invest in quality bank stocks. Many banks’ stocks are on sale following the SVB failure. However, not all bank stocks are the same. We believe the current situation is an opportunity for several large banks to gain market share and our equity team has identified several promising opportunities.

Curi Capital is committed to the long-term financial success of our clients, and we’re focused on making sure our clients are appropriately positioned for current markets and invested in a manner that aligns with their financial plan. As always, If you are interested in reviewing your portfolio, discussing potential actions, or exploring what Curi Capital can do for you, please reach out to a member of our team at 984-202-2800.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi Capital is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi Capital can be found in its Form ADV Part 2, which is available upon request.

Past performance is not a guarantee of future results. All investment strategies involve risk and have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio. References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and indexes do not reflect the deduction of the advisor’s fees or other trading expenses.

Curi Capital clients should contact the Company if there have been changes in the client’s financial situation or investment objectives, or if the client wishes to impose any reasonable restrictions on the management of the client’s account or reasonably modify existing restrictions.