It’s nearly impossible to talk about the future without mentioning artificial intelligence (AI). It’s in our headlines, our conversations, and increasingly, in our daily lives. At Curi Capital, we’re not just watching AI unfold; we’re actively pursuing the opportunities this momentous shift presents for our clients and our investments.

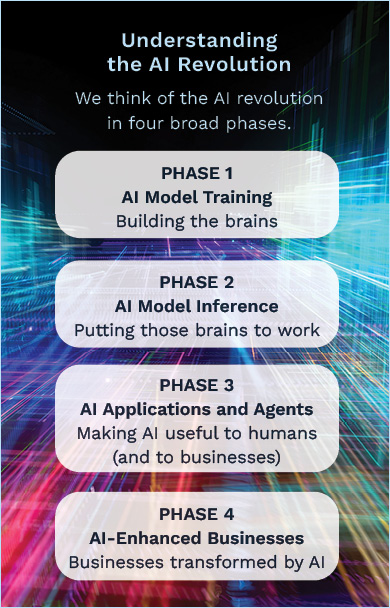

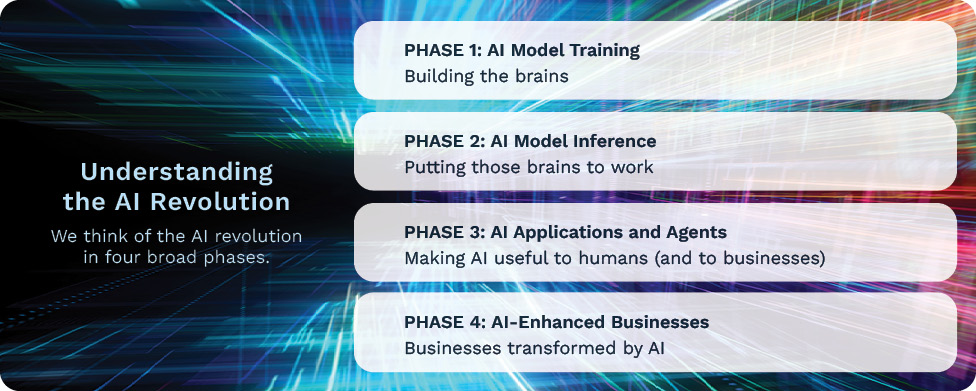

It’s helpful to have a practical framework to understand how AI is evolving, how it creates value over time, and how Curi Capital is approaching this fast-moving field from an investment perspective.

We’re still early in the big picture, and there’s a long runway ahead for innovation, adoption, and value creation — and each phase presents unique investment opportunities. Here’s a rundown of how our team expects AI value creation to proceed and how we’re discussing these opportunities in recent client conversations.

Phase 1: Training the Models

AI starts with training, a process that entails feeding massive amounts of data into powerful computers so they can learn to recognize patterns, make predictions, or perform tasks like driving a car or writing code.

The current phase of AI is similar to the early days of the internet — people knew it would be revolutionary, but it wasn’t ready for widespread use. That’s where we are with AI today. Exciting things are happening, but much of it is still in development.

The companies training AI models and selling access to those models, such as OpenAI, Anthropic, or Meta, aren’t the only ones benefiting in this stage. In fact, some of the biggest winners are the ones supplying the tools to make that training possible. That includes semiconductor makers like Nvidia, cloud infrastructure providers like Microsoft Azure and Amazon AWS, and data center real estate and utility infrastructure firms powering the computing revolution. These are the “pick-and-shovel” players—the foundational businesses enabling the AI gold rush.

Phase 2: Model Inference

Once trained, AI models can start working, in a process called inference. This is when an AI uses what it has learned in training to answer questions, write code, spot patterns, or analyze language.

Unlike training, inference happens over and over again. This recurring nature makes it a highly attractive business model: companies can charge licensing or usage fees for every query processed through an AI model.

And as training and inference costs drop thanks to innovations from companies like DeepSeek, who rocked the AI world and global markets in January 2025 with its announcement of its R1 AI chatbot application, we expect adoption to spread rapidly. That growth benefits companies in infrastructure software and platforms that power AI. Examples of these kinds of companies include Snowflake (modern data platforms), MongoDB (databases built for scale), and CrowdStrike (cybersecurity for AI systems). These firms help businesses become AI-ready by providing the technology infrastructure needed for them to effectively and securely utilize AI models.

Phase 3: Applications and Agents

The next big leap comes when AI becomes easy for the average person to use. Just as internet browsers made the web accessible in the 1990s, AI applications will bring the power of models to the masses.

Applications are interfaces such as chatbots, software tools, and virtual assistants that let humans interact with AI. Companies are already embedding these tools into the software we use every day. For example, Salesforce and Microsoft now include AI-powered features that summarize emails, generate responses, and create tasks—saving users time and effort.

Even more powerful are agents—AI tools that can take action on their own, based on parameters that developers set. Think of them as tireless digital workers, constantly operating behind the scenes. The companies building and implementing these applications and agents—whether through their own models or by leveraging third-party models like OpenAI’s—are already beginning to unlock significant productivity gains.

Other players in this phase include companies like Intuit, which uses both proprietary and third-party AI models to power its suite of financial software tools for individual and small businesses, and consulting firms like Accenture that help businesses figure out how to implement and scale AI-driven tools effectively.

Phase 4: AI-Enhanced Businesses

Finally, we reach the point of businesses using AI to change how they operate. These are companies that are embedding AI deep into their business models to become smarter, faster, and more efficient.

Some businesses are using AI to sharpen existing operations. Take Visa, for example, which uses AI to more effectively detect and prevent fraud—saving money and creating competitive advantages. Others are being built from the ground up around AI. For instance, Waymo (the self-driving vehicle company from Google) simply wouldn’t be possible without AI.

Looking ahead, many of the most transformative businesses of the AI era may not even exist yet, just like Facebook didn’t exist until a decade after the internet went mainstream. That’s why it’s important to invest not just in today’s winners but in companies that will create and leverage tomorrow’s innovations.

Our Investing Approach: Mapping the Phases of the AI Rollout

To make sense of all of this, we use a simple framework to orient us within the phases of the AI rollout. It also helps us identify the most promising opportunities in each phase, from the companies writing the software, to those supplying the metaphorical picks and shovels, to the future businesses we can’t yet imagine.

We know that each phase builds on the one before it. As more models are trained, there is a greater need for the infrastructure to access those models. As more infrastructure is built, applications and agents will proliferate. As applications and agents become more abundant and effective, more consumers and businesses adopt and benefit from them. Each stage of the rollout creates new beneficiaries and new investment opportunities.

The opinions and analyses expressed in the article are based on Curi Capital, LLC's research and professional experience. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. Investors should consult with their trusted professionals prior to taking any action.