Seeking Comfort through Uncertainty: Private Markets Overview Q2 2022

It’s nearly impossible to turn on the news without hearing talk of inflation, rising interest rates, and the impending recession. These headlines can be unnerving for individuals, and rightfully so. As investors, it’s our job to look past the headlines, tune out the noise, and focus on what matters.

However, this is easier said than done.

MARKET UNCERTAINTY

Markets are volatile. Humans are emotional and tend to be prisoners of the moment. It’s hard to know where to allocate capital with any degree of confidence. Markets are notoriously difficult to time.

Thankfully, private markets have historically provided solitude from the day-to-day uncertainty, as they are, by definition, long-term. A typical commitment to private equity, for example, is invested over a 3–5-year period with realizations not occurring for another 3-5 years.

TODAY MATTERS

Make no mistake, private markets will undoubtedly be impacted by current market dynamics. Entry multiples could be correlated to public market valuations and capital structures will vary based on the availability of credit, and the level of interest rates. Exit activity will be impacted by the robustness of the IPO market.

However, decisions made by general partners are meant to be accretive over a prolonged horizon. Managers in private markets have the luxury to look past the noise and focus on what matters: maximizing long-term value for their investors.

INVESTMENT ACTIVITY

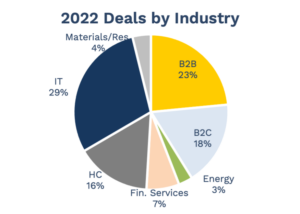

During the second quarter, deal activity remained strong, although modestly behind the historical pace of 2021. Information Technology continued to be the focus of investors, with the sector seeing nearly 30% of total deal volume year-to-date. The first half of the year has been highlighted by a small number of mega-deals including S&P Global closing its $44 billion acquisition of IHS Markets.

Source: Pitchbook through June 30, 2022

EXIT ACTIVITY

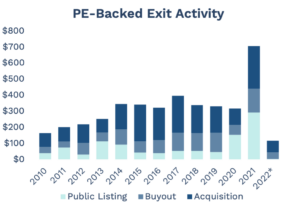

During times of uncertainty, buyers want to pay today’s price while sellers are only willing to accept yesterday’s. Negotiations break down and activity slows. Exit activity in 2022 has collapsed given a non-existent IPO market and a challenging interest rate environment for M&A financing. Managers are being forced to rethink their exit strategies and extend hold periods.

*Source: Pitchbook through June 30, 2022

VALUTATIONS

While public equities tend to be forward looking instruments, the same cannot be said for private markets. Generally, private investment valuations are based on fundamentals. As such, it may take some time for valuations to reflect economic reality. Private equity has seen multiples expand so far in 2022, which is likely a result of managers only selling their best and most resilient assets. Anecdotally, there have been several venture darlings forced to raise down rounds this year. BlockFi, a crypto financial services firm, participated in a round that valued the business at $1 billion, an 80% haircut to the $5 billion value reported in 2021.

*Source: Pitchbook through June 30, 2022

FUNDRAISING ACTIVITY

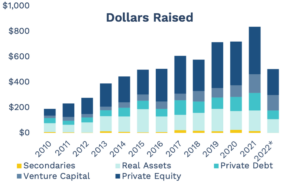

2021 was a banner year for fundraising. Portfolio values were high and general partners were rushing to market their successes. But as 2022 has shown, what goes up must come down. Fundraising activity has decelerated as investors are forced to make difficult pacing decisions with slowing distributions and a high percentage of their current GPs coming back to market with large fundraise targets.

*Source: Pitchbook through June 30, 2022

As long-term investors, our team at Curi Capital is excited about the investment opportunities that we believe lie ahead. We are focusing our time and effort searching for promising investment opportunities to deliver to our clients.

If you are interested in reviewing your portfolio, discussing potential actions, or exploring what Curi Capital can do for you please reach out to a member of the Curi Capital team at 984-202-2800.

Curi Wealth Management, LLC, dba Curi Capital (“Curi”), is an investment adviser in Raleigh, NC. Curi is registered with the Securities & Exchange Commission (“SEC”). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the SEC. Curi only transacts business in states in which it is properly registered or is excluded or exempt from registration. A copy of Curi’s current written disclosure brochure filed with the SEC which discusses among other things, Curi’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Past performance is not a guarantee of future results. All investment strategies have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio. Private Investments are typically offered to qualified investors who meet certain income or investable asset minimums.