Maximum Pain: Q4 2022 Market Commentary

The third quarter was another volatile quarter for markets as central banks around the world continued hiking interest rates to get high inflation under control. The S&P 500 rallied 17.7% from its June 16 low to its summer high on August 16, before falling -16.5% to finish the quarter down -4.9%.

Bonds were no better than stocks with the Bloomberg Aggregate Bond Index down -4.8% for Q3. The S&P 500 Index is down -23.9%, and the Bloomberg Aggregate Bond Index is down -14.6% year-to-date through September 30. [1]

To put this quarter into context, it’s the first time since 1976 that bonds and stock returns have been negative for three consecutive quarters. [2]

While many factors drive markets at any one time, we believe the driving factor in today’s market is persistently high inflation. While we believe inflation has peaked in the U.S., the Consumer Price Index (CPI) has not declined meaningfully, and prices continue heading higher in other countries, such as the United Kingdom. As such, the Federal Reserve continued aggressively hiking rates and reiterated a very hawkish stance going forward.

CONTINUED TURBULENCE FOR INVESTORS

Unfortunately, investors should prepare themselves for turbulence to continue as markets struggle to find and form a more durable bottom. The immediate concern for the market is earnings as October is a big month for earnings.

We believe earnings estimates are at risk and expect October to be another volatile month. All of the market declines this year have been due to lower price-to-earnings multiples and not lower earnings.

BALANCE OF POWER

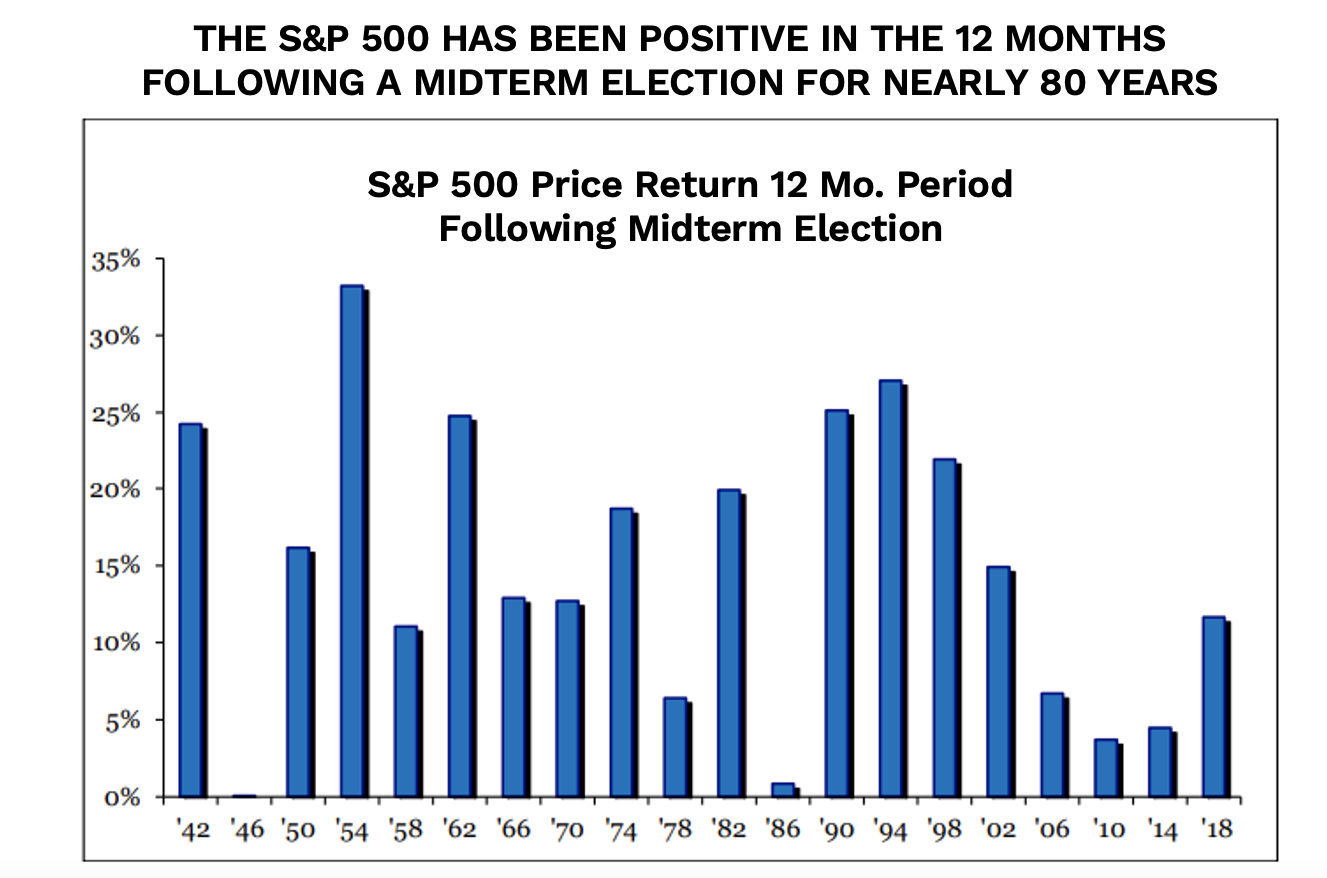

Not all the news is negative. First, post mid-term elections may prove a much more favorable environment for markets. We’ll know the balance of power following the mid-term elections. Republicans will likely take back at least one and potentially both chambers of Congress, resulting in a split government—often viewed as favorable to the stock market.

History also provides reassurance. Since 1942, the market has always been positive the twelve months following a mid-term election. [3]

Source: Strategas. Data as of September 19, 2022

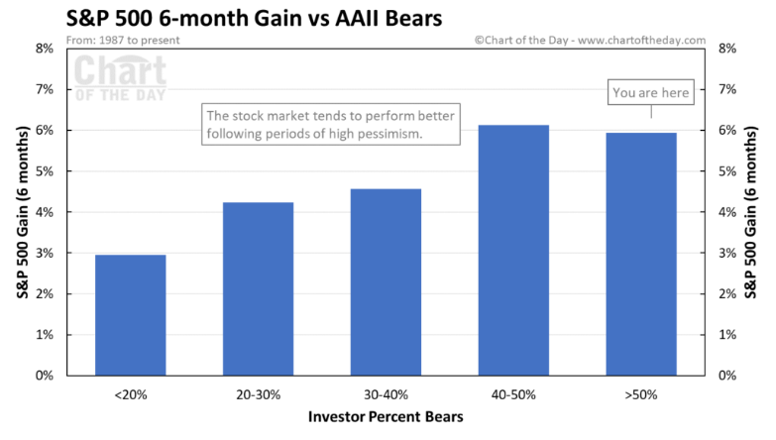

Another positive development is negative investor sentiment. One sign of a bottom is extreme negative sentiment, and we’re seeing signals indicating pessimism is extremely bearish. More than 60% of investors are bearish, according to the AAII US Investor Sentiment as of September 29, 2022.

The highest percent of AAII bearish sentiment was 70% in March 2009 near the market lows of the Great Financial Crisis. Six month forward S&P returns have been strong in the past when bearish sentiment gets to these levels as the chart below demonstrates. [4]

Source: www.chartoftheday.com. Data as of September 30, 2022

INVESTMENT OPPORTUNITIES LIE AHEAD

Finally, it’s helpful to remember that the S&P 500 Index has ALWAYS returned to previous highs. We believe it’s a question of when, not if, the stock market (and bond market) recuperates from this year’s losses.

As long-term investors, our team at Curi Capital is extremely excited about the investment opportunities we believe lie ahead. We are focusing our time and effort searching for promising investment opportunities to deliver to our clients while navigating volatile markets likely to persist in the short-term.

If you have had changes to your financial situation or investment objectives, or are interested in reviewing your portfolio, discussing potential actions, or exploring what Curi Capital can do for you, please reach out to a member of the Curi Capital team at 984-202-2800.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi Capital is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi Capital can be found in its Form ADV Part 2, which is available upon request.

Past performance is not a guarantee of future results. All investment strategies have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

[1] Source: Bloomberg Finance, LP

[2] Source: Grabinski, Ryan. “Stocks And Bonds On Pace For 3rd Consecutive Negative Quarter – The Daily Macro Brief” Strategas. September 30, 2022.

[3] Source: Clifton, Dan. “Midterms & Markets.” Strategas. September 19, 2022.

[4] Source: www.chartoftheday.com