Yours, Mine and Ours? When Couples Navigate Money Discussions

When you and your partner start to map out common financial goals, your relationship enters a new territory—the money talk. Your goals may start out short-term and fun, like planning a vacation or saving for a house.

But over time your money talks become long-term and serious, like saving for college, debt repayment, or retirement timelines. No matter the money’s impact or timeline, your emotional trips and triggers can derail an otherwise cohesive relationship faster than you can say “red flag.”

As a financial planner myself, I am hardly immune to money’s emotional roadblocks. When my husband and I bought our house, he suggested we open a joint checking account funded by a portion of our payroll deposits. The joint account, he offered, could be used to pay house expenses and cover our monthly mortgage bank draft. While his plan was sage and fair, my emotions swelled into a defensive posture. As the daughter of a single parent, I was taught to protect my finances and plan diligently. Yielding control over any portion of my payroll was not something I wanted. In my childhood, I saw how money influenced relationship dynamics—both by generosity and withholding—and my emotions were telling me to avoid repeating that scenario. Eventually, I agreed to one joint account. Now we have several.

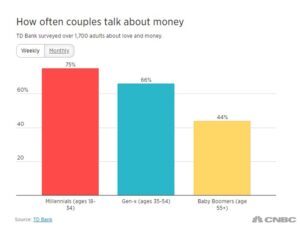

When two people come together—and opposites often do attract—two different sets of financial socialization experiences, values, and narratives come together, too. As children, we hear money discussed and observe how emotions are expressed and conflict is resolved. Over time, we form preferences about how vulnerable we want to be. Some of us are taught to never discuss money or stay vague. But when it comes to managing money with a partner, if you are specific and transparent and take time to understand each other, then you can gain traction together. That said, 10% of couples do not talk about money, even once a month. But that is progressing with each generation.

So what does money mean to you? Does it provide financial security, an opportunity to support causes, or a chance to do something fun? If money has a different meaning to you as an individual than as a couple, be ready for a collision course of different expectations and emotions.

Rather than jumping tracks, you can plow through money discussions with patience and diligence. Regular communication can take your relationship to a higher level of satisfaction (Archuleta et al 2011). While some degree of conflict is inevitable, productive conflict is a welcome opportunity. Some signs of non-productive conflict are:

- Fatigue

- Withdrawal or disengagement

- Changing the subject

- Finding a distraction

- Less patience

- A heart rate >100 bpm

A break in discussion does not mean you end the conversation, just delay it. For example, “I can tell this subject is starting to drain us both, can we make a plan to discuss tomorrow morning over coffee?”

You might be wondering, “Where do we start?” Here us a list of open-ended questions to guide “the money talk”:

- What are your expectations? Thoughts on debt?

- How do you feel about supporting parents, children, or siblings?

- How can we respect the inequities of our income, expenses, or inheritance?

- Should our accounts be joined, separate or a combination?

- How will we cover large expenses?

- What are your short-term, long-term and retirement goals?

- What are your non-negotiables?

No matter where you are on your financial path, remember that you and your partner have different backgrounds, values, preferences, and goals. When you communicate your individual perspectives, you are more likely to be seen and understood by each other. Even if you don’t agree on every detail, some common ground can be found, and your relationship strengthens by planning together.

Disclosure: Curi Wealth Management, LLC, dba Curi Capital, is an investment adviser in Raleigh, North Carolina. Curi Capital is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the SEC. Curi Capital only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Curi Capital’s current written disclosure brochures, filed with the SEC, which discuss, among other things, Curi Capital’s business practices, services and fees, are available through the SEC’s website at: www.adviserinfo.sec.gov.

Citations:

Gottman, John Mordechai, and Nan Silver. The Seven Principles for Making Marriage Work: A Practical Guide from the Country’s Foremost Relationship Expert. New York: Harmony Books, 2015.

LeBaron, Ashley B, and Heather H Kelley. “Financial Socialization: A Decade in Review.” Journal of family and economic issues. Springer US, November 10, 2020. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7652916/.

Leonhardt, Megan. “75% Of Millennial Couples Talk about Money at Least Once a Week-and It Seems to Be Working for Them.” CNBC. CNBC, July 31, 2018. https://www.cnbc.com/2018/07/27/75-percent-of-millennial-couples-talk-about-money-at-least-once-a-week.html.